Britain’s growth rate picked up in the last three months, but remains ‘subpar’ amid uncertainty over the UK’s future

- Service and manufacturing grew over the summer

- Construction is in recession

- Pound rises - interest rate rise more likely

- Robert Kennedy: What GDP doesn’t measure

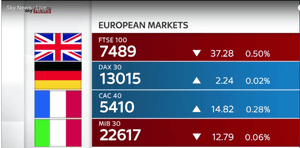

European markets end lower

The stronger than expected UK growth figures have given a lift to the pound on the basis that an interest rate rise next week is almost certain. With sterling up nearly 1% against the dollar, the FTSE 100 has fallen back thanks to its host of overseas earners which lose out when the pound is stronger. German and French markets also fell back as investors took profits, while Wall Street came back from its record highs after a handful of disappointing results. The final scores in Europe showed:

- The FTSE 100 finished down 79.33 points or 1.05% at 7447.21

- Germany’s Dax dropped 0.46% to 12,953.41

- France’s Cac closed down 0.37% at 5374.89

- Italy’s FTSE MIB fell 0.81% to 22,446.39

- Spain’s Ibex ended 0.51% lower at 10,153.3

- But in Greece, the Athens market edged up 0.01% to 737.25

On Wall Street, the Dow Jones Industrial Average is currently down 164 points or 0.7%.

On that note, it’s time to close for the day. Thanks for all your comments, and we’ll be back tomorrow.

FacebookTwitterGoogle plus

Wall Street’s falls are accelerating, with the Dow Jones Industrial Average now down 95 points or 0.4%.

Following its recent record breaking run, any disappointment in the host of earnings reports coming out looks like an excuse for some profit taking. Joshua Mahony, market analyst at IG, said:

The recent US stock market surge came to a halt today, as the positive earnings releases of days gone by were nowhere to be seen. With 70% of S&P 500 earnings beating estimates, it is no surprise that confidence has been sky high of late. However, given the underperformance of AT&T and Boeing earnings, it’s not a shock that the wider S&P 500, Dow and Nasdaq markets are all in the red as we realise that further earnings outperformance may not be a given.

FacebookTwitterGoogle plus

Sterling remains strong against the dollar, now up nearly 1% at $1.3261. Connor Campbell, financial analyst at Spreadex, said:

The pound continued to romp higher this Wednesday, as investors indulged in a hawkish view of the morning’s UK third quarter GDP reading.Despite a better than expected pair of durable goods orders figures from the US – the core reading rose to 0.7%, while the non-core number hit 2.2% – cable widened its gains as the day went on.All this put the FTSE in a miserable mood, with the UK index dropping 50 points to fall to its lowest price in nearly 3 weeks. With the likelihood of a November rate hike from the BoE only increasing following the (slightly) better than forecast third quarter growth reading – leaving sterling in line for another boost – the UK index may struggle to muster the momentum required to climb back, and stay, above 7500 in the coming weeks.

Since you’re here … we have a small favour to ask. More people are reading the Guardian than ever but advertising revenues across the media are falling fast. And unlike many news organisations, we haven’t put up a paywall – we want to keep our journalism as open as we can. So you can see why we need to ask for your help. The Guardian’s independent, investigative journalism takes a lot of time, money and hard work to produce. But we do it because we believe our perspective matters – because it might well be your perspective, too.

If everyone who reads our reporting, who likes it, helps fund it, our future would be much more secure. You can give to the Guardian by becoming a monthly supporter or by making a one-off contribution. - Guardian HQ

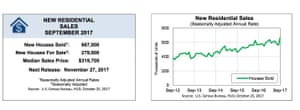

US home sales for September have jumped sharply to the highest level in a decade, confounding expectations of a small decline.

LiveSquawk(@LiveSquawk)US New Home Sales Change Sep: 667K (exp 554K; R prev 661K)October 25, 2017

-New Home Sales (M/M) Sep: 18.9% (exp -1.1%; R prev -3.6%)

Updated

FacebookTwitterGoogle plus

Uncertain start for Wall Street

After their recent record breaking run, US markets have paused for breath.

A handful of companies including Chipotle and AMD released underwhelming updates, giving investors an excuse to hold fire after what has up until now been a positive earnings season.

The Dow Jones Industrial Average is currently down around 2 points while the S&P 500 opened 2.79 points lower and the Nasdaq Composite lost 10.62 points.

FacebookTwitterGoogle plus

Back with UK GDP, and here are chancellor Philip Hammond’s latest thoughts on the figures:

Philip Hammond(@PhilipHammondUK)

Innovation will power the British economy of the future. My thoughts on the UK GDP statistics out today. pic.twitter.com/T97unCi5KoOctober 25, 2017

FacebookTwitterGoogle plus

On the latest US data, Dennis de Jong, managing director of UFX.com, said:

President Trump will be heartened by today’s durable goods orders, which have come in well above expectations and point towards a manufacturing sector performing strongly, despite an uncertain economic backdrop.The challenge for Trump will be maintaining this momentum, with a big decision due in the coming weeks on the future Janet Yellen as Fed chair.Having run on a jobs platform during last year’s election, the president will also need to find a way of ensuring that strong manufacturing performance leads to an uptick in job and wage growth.

FacebookTwitterGoogle plus

US capital goods orders beat forecasts

Over in the US, there have also been some better than expected economic figures.

New orders for US made capital goods - excluding defence and aircraft - jumped 1.3% in September, better than the 0.5% rise expected by analysts. The August figure was also revised upwards, from an initial 1.1% to 1.3%.

The data comes ahead of Friday’s third quarter GDP estimate, which is expected to show an impressive annualised rate of 2.5%, albeit down from the second quarter’s 3.1%.

The positive figures will add to the expectations that the Federal Reserve will raise US interest rates again before the year end.

FacebookTwitterGoogle plus

UK GDP: A recap

OK, time for a quick catch-up on this morning’s growth figures.

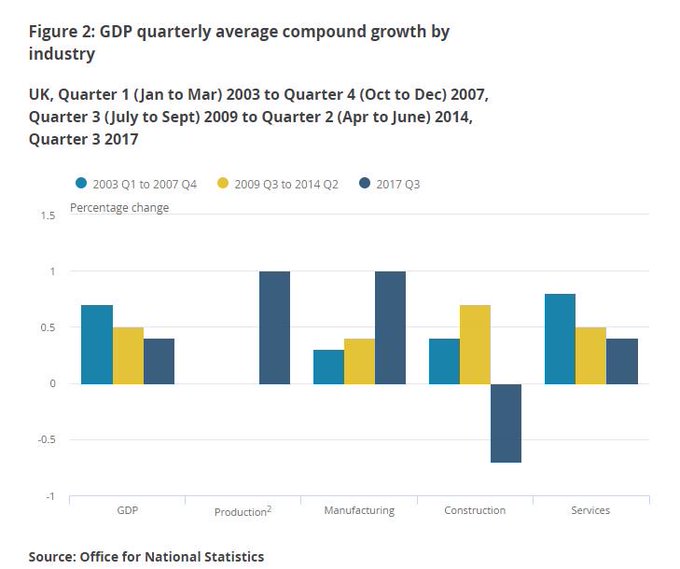

Britain’s economy grew a little faster than expected in the third quarter of this year, but still below its long-term growth rate.

GDP rose by 0.4% in July-September, ahead of City expectations. It’s an increase on the 0.3% growth recorded in the first two quarter of 2017, but still a fairly moderate performance.

The service sector, which makes up around three-quarters of the economy, grew by 0.4%.

Manufacturing, encouragingly, grew by 1% during the quarter. But construction suffered its second quarterly contraction in a row.

Ed Conway @EdConwaySky

GDP growth of 0.4% in the third quarter. Better than expected. But still below long-term trend. Here's how different sectors contributed:

Darren Morgan, the Office for National Statistics Head of National Accounts, explains:

“Growth in the third quarter of 2017 continued at a similar rate as seen in the first half of the year. Services, led by increases in IT, motor trades and retail, continued to drive GDP growth.Manufacturing also boosted the economy with an improved performance after a weak second quarter.

Chancellor Philip Hammond said it was a “solid” performance, as Britain’s economy continued to outperform expectations. But his Labour opposite number, John McDonnell, criticised the government for not investing more.

City economists have generally agreed that the UK economy looks somewhat lacklustre. Several blamed the Brexit vote, for cutting the value of the pound and deterring firms from investing in new machinery and buildings.

Kallum Pickering of German bank Berenberg sums up the mood:

The current pace of UK GDP growth is ok, but it could be better. While the short-term risks to demand since the Brexit vote have not materialised in a serious way, the UK economy should be riding high on the back of the on-going global upswing.Uncertainty from Brexit is weighing on firm and household confidence.

The forecast-beating growth figures appear to increase the chances of an interest rate rise next week. That sent the pound rallying almost 1% today.

This has pulled down Britain’s FTSE 100 share index, as a stronger pound undermines the value of overseas earnings.

FacebookTwitterGoogle plus

Pound jumps on rate hike forecasts

Sterling has now gained a whole cent against the US dollar today, to $1.325.

City investors seem increasingly confident that the Bank of England will raise interest rates next week, on the back of today’s growth figures.

An interest rate rise would help savers, but could be bad news for over-stretched borrowers. With real wages shrinking this year, many households have been forced into debt to pay for basic items.

Fran Boait, director of the Positive Money campaign group, argues that interest rate shouldn’t rise until wages have caught up with inflation.

With many people already drowning in debt, even a small increase in mortgage rates and credit card bills could push them under. People urgently need a boost to their incomes before any rise in interest rates. Our message to the Bank of England and the government is that there should be “No rate rise without a pay rise”.

FacebookTwitterGoogle plus

Difficult times call for radical measures...and Labour MP Liam Byrne argues that Britain needs to rethink its economic model to get growth motoring again.

Writing in the Guardian, Byrne says:

London is an incredible 40% more productive than Wales. And in contrast to the shibboleths of traditional growth theory, our regions are failing to converge over very long periods of time. A bold new model would grant new fiscal freedoms to regions to borrow to invest in infrastructure and housing – as first proposed by the Keynes-inspired 1944 white paper on full employment. Devolution of the apprenticeship levy would rescue a failing policy and allow regions to coordinate technical education. And a radical boost to the Higher Education Innovation Fund would transform the power of regional universities to provide research and development to Britain’s underproductive small business base.However elegant the strategy, said Winston Churchill, it’s good to occasionally look at the results. Today’s economic results are disappointing. It’s time to change the theory and practise of the strategy.

Liam

✔@LiamByrneMP6/. Our economic model needs to change. Here's how: https://www.theguardian.com/commentisfree/2017/oct/25/uk-economy-failing-fix-growth-regional-fiscal-freedoms …

Updated

FacebookTwitterGoogle plus

Duncan Weldon, head of research at the Resolution Group, says the big picture is that Britain’s economy has slowed over the last decade.

That’s partly due to Britain’s weak productivity - a problem that no-one seems close to solving.

But Brexit doesn’t help, he writes:

Increased uncertainty over the UK’s future trading relationships, regulations and migration policy have led many firms to put investment on hold. The British economy has no doubt performed better than many analysts (including this one) expected since the referendum, but that performance still can’t be termed “strong”. It is important to remember that the UK’s better-than-expected performance – relative to the most pessimistic pre-Brexit vote views – has come at a time when the global economy as a whole has been putting in a stronger performance.This month the International Monetary Fund estimated that the global economy would grow 3.6% in 2018 and that advanced economies would expand by 2.2%. Those numbers compare to estimates of 3.2% and 2.0% before June’s referendum. Meanwhile they now pencil in growth of just 1.7% for the UK next year as opposed to an estimate of 2.2% 18 months ago. In other words, while the prospects for the world economy and other developed countries have improved, our own outlook has darkened.

No comments:

Post a Comment